How to make the most of resilient capital markets

and an extended runway

Overall, the U.S. economy has performed stronger than many

expected in 2023, and the Fed may be close to pulling off its

elusive “soft landing,” bringing inflation under control

while avoiding a recession.

The strong economy and capital markets have been a boon to both

consumers and corporates. Credit markets, even for lower-rated

companies, have been resilient over the past few months and

sponsors continue to get deals done. Refinancing activity,

distressed exchanges, and liability management exercises have

pushed out many of the normal liquidity and debt wall triggers that

lower-rated credits would otherwise face. Double-dips, drop-downs,

and other creative financing tools are being used with increasing

frequency, buying both time and optionality.

As borrowers look to access these markets while the window is

still open, they must understand the consequences of increased

capital costs and take advantage of the newfound runway to

implement operational changes.

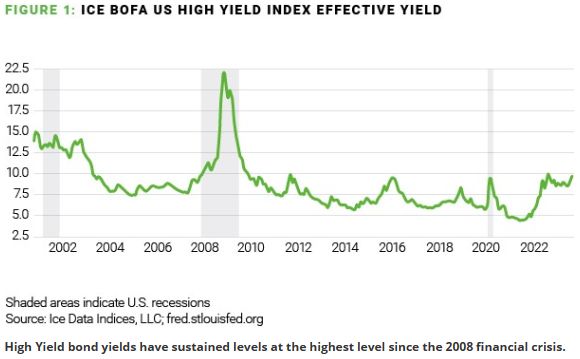

Markets are resilient…but at a cost

Although Chairman Powell’s recent comments signaled a freeze

to additional rate hikes in the near term, he demonstrated the

Fed’s determination to keep rates higher for longer. The strong

Q3 GDP print adds further uncertainty to future rate moves and

markets will continue to watch closely for signs indicating that

the Fed may truly pause or instead continue increases. As the

markets continue to digest the higher for longer mantra, interest

rates continue to set decade-long highs with the 10-year yield

crossing the 5% threshold for the first time in 16 years and lower

rated credit yields reaching peaks not seen since the 2008

financial crisis.

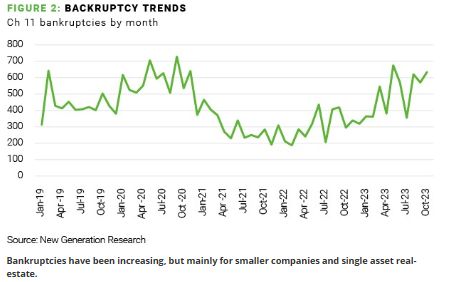

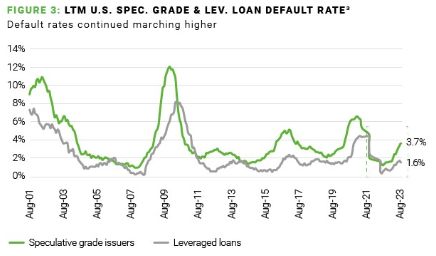

Given this environment, perhaps it’s no surprise that

bankruptcies are also on the rise. Through October, U.S.

bankruptcies are at their highest levels since the pandemic (Figure

2) and may end the year at levels not seen since 2010.

However, much of the increase is a result of smaller companies

and those in the real estate sector, in particular, feeling the

squeeze.

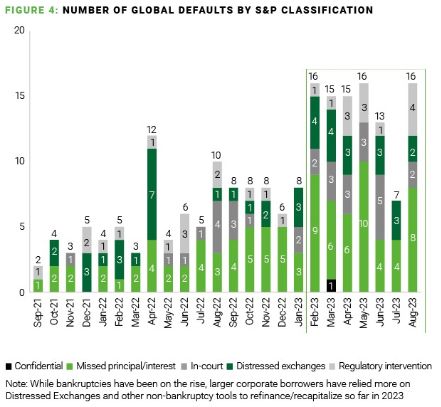

Larger corporates, with access to creative financing options,

have tapped the markets more readily, buying themselves time and

optionality outside of court.

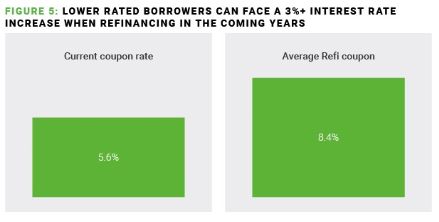

Lower rated companies who are evaluating refinancing options

need to be aware of the potential cost. Currently, speculative

grade credits who have sizable maturities in 2024 and 2025 have an

average coupon rate of 5.6%, however, the average yield for those

same borrowers now averages 8.7% as markets factor in individual

credit concerns and account for the recent shift in the wider

interest rate environment1. Additionally, the average

coupon on refinanced loans for similarly situated, speculative

grade credits, has averaged 8.4% over the past 6

months2.

Borrowers must be acutely aware of the fact that their actual

cash interest payment may increase by 3%, or more, when considering

their options, especially crucial for companies facing business and

operational challenges.

Evaluating your options; liability management will no doubt be

discussed

For companies evaluating their options to tackle near term

maturities, many will have discussions about various liability

management transactions available based on the specific structure

of their credit documents and overall creditor makeup. These

transactions often provide solutions to near-term maturity walls

and increase optionality given an extended liquidity runway.

To best evaluate and execute on these options, it’s

important to map out the path to operationalize the transaction and

understand the long-term implications to the operations and cash

flows of the business. For example, double-dips and drop-downs

require an understanding of the cash flows between parents and

subsidiaries and any effect on operations or shared services

between them. Uptiers require a collateral analysis and a review of

the borrowers ability to service new debt. Chewy releases and asset

sales call for effective execution of spin-offs and carveouts, as

well as an analysis of the impact on go-forward operations and the

ability to service new debt.

Utilizing the options made available in borrower friendly credit

documents and an open window in the credit markets to tap these

transactions can buy a company time and runway. Effectively

executing the transaction and planning for the post-transaction

operational improvements will be key to taking advantage of this

runway.

So, you’ve bought some time

Taking additional liquidity and buying additional time are all

overall positives in the short term.

Taking full advantage of this opportunity requires concentrating

on two critical realities:

- Financial maneuvers cannot fix operational

challenges. Recent examples abound of companies falling

back into distress or even filing for bankruptcy after undertaking

a refinancing (particularly expensive ones) or liability management

exercises over the past few years. - Interest coverage is the name of the game.The

face of leverage has changed in this new high-rate world. Previous

leverage metrics are not nearly as telling as a review of interest

coverage. The current cost of credit, and a company’s ability

to truly service their ongoing debt costs will need to be accounted

for when undertaking new financial moves.

What should you do next?

As we outlined inour 18th annual Turnaround and

Transformation Survey, the number one challenge restructuring

experts see in the year ahead is the cost and availability of

capital. That reality is not going away anytime soon.

First, map out a business plan with both the financial and

operational overlays, with a true liquidity and working capital

forecast. One place where many fall short is being realistic about

operational realities. Lay out different scenarios and understand

how revenues and cash flows will be impacted.

Doing so will give you a better sense of the future and avoid

unexpected surprises. Staying informed and being adaptable and open

to new opportunities can help you pivot when necessary.

Second, understand how bottom lines will be affected by

increased capital costs.Game plan for operational maneuvers to minimize

these impacts. A decade of cheap credit may have lulled many

management teams to ignore the significant cost of covering their

debt and resulting decrease of cash to invest elsewhere.

Remember that building a financial buffer takes time and

discipline. Even if your growth expectations don’t meet your

initial targets, having a financial buffer in place will provide

you with a safety net and financial security. More tactically,

identify non-productive assets to shed, analyze and determine your

highest (and lowest) ROI investment opportunities, and prepare a

zero-based budget to pinpoint the key areas requiring management

and employee focus. Identifying these areas, sticking to your

investment strategy, executing the company’s strategy, and

effective communication with employees and investors will help

companies prepare themselves for life in a higher rate world.

Gaining additional time is just the first step in fixing a

company that is struggling. Take advantage of this

opportunity: Mapping out a realistic go-forward business

plan and applying operational effectiveness to financial maneuvers

is the only way to ensure long-term success.

Footnotes

1 Source – Bloomberg – US speculative grade credits

rated CC- to BB+ with loans greater than $250mm maturing in 2024

and 2025

2 Source – Bloomberg – US speculative grade credits

rated CC- to BB+ with loans greater than $250mm who have refinanced

since April 2023

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.